Strong AI bets are fueling growth, according to Alphabet and Microsoft’s earnings.

Strong AI bets are fueling growth, according to Alphabet and Microsoft’s earnings.

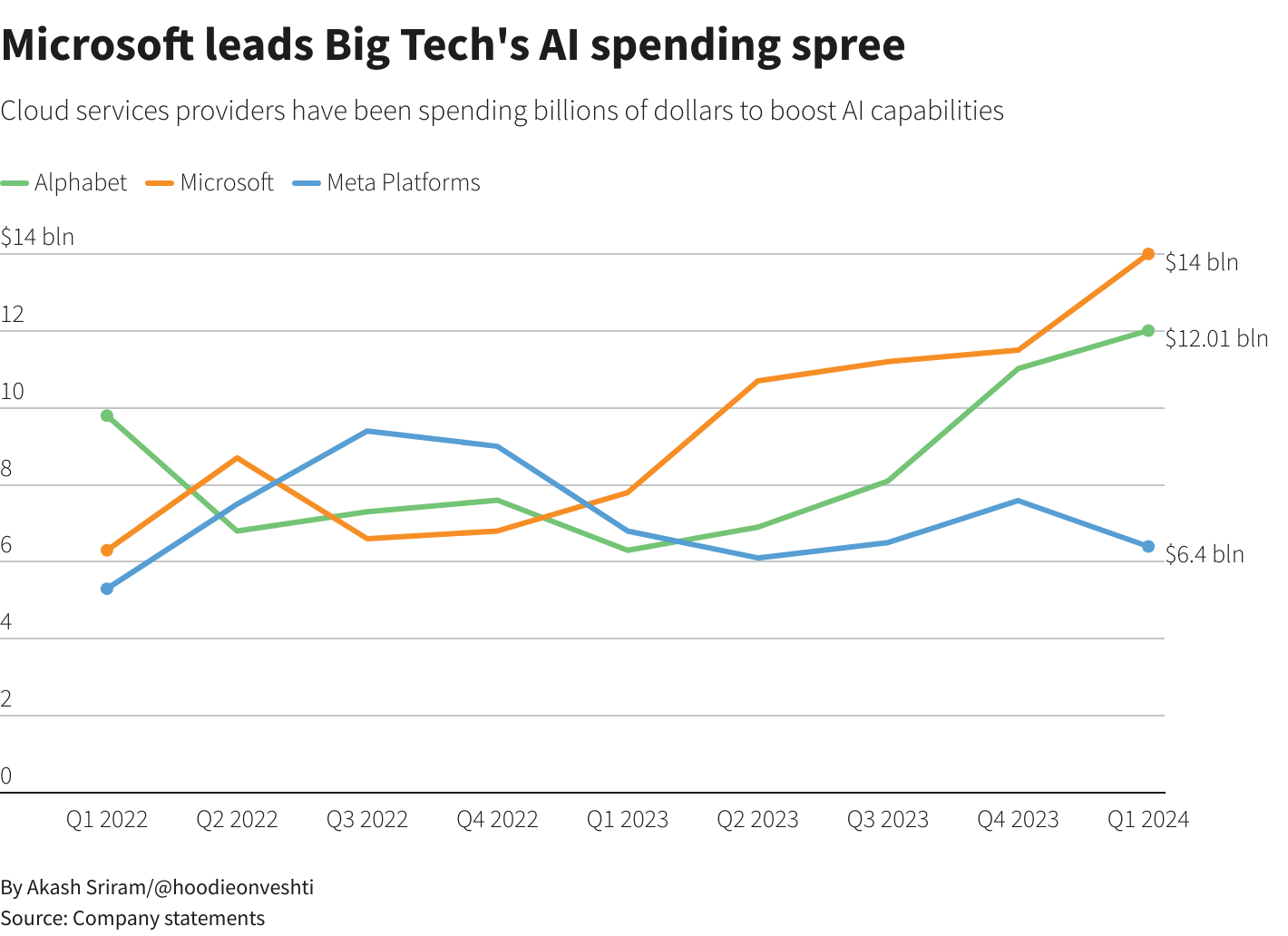

(Reuters) – April 26 With earnings that demonstrated significant AI expenditures were driving growth, Alphabet and Microsoft on Friday spurred a rally in technology equities and dispelled concerns that their expensive projects would take years to pay off following a cautious prediction from Meta Platforms.

According to LSEG data, Alphabet jumped 10% and finished with a stock market value above $2 trillion for the first time after the business rewarded investors with a $70 billion stock repurchase and its first dividend.

LSEG Datastream reports that more than three years ago, the fourth most valuable company in the world toyed with the idea of reaching the milestone on an intraday basis.

Microsoft’s market worth increased by around $54 billion, or nearly 2%.

Both Alphabet (GOOGL.O) and Microsoft (MSFT.O), opened a new tab and reported that their quarterly revenue growth was exceeding expectations as more users turned to services like the Copilot AI assistant and the Gemini chatbot. This is after investing billions of dollars in the infrastructure needed to support AI applications.

According to Amy Hood, finance chief, artificial intelligence services contributed seven percentage points to Microsoft’s Azure cloud computing platform’s 31% revenue increase between January and March.

She also mentioned that the company’s capacity was not fully meeting the near-term demand for AI, which hindered the company’s development during the quarter and underscored the necessity of investing in infrastructure expansion.

With robust growth in Google Workspace, where the Alphabet subsidiary provides a plethora of AI services driven by its massive language model Gemini, cloud income at Google increased by roughly 28%.

The social media behemoth Meta (META.O), opens a new tab and warned of increased spending and slower-than-expected growth, which contrasted with the results. On Thursday, Meta’s shares fell 10%.

“This quarter illustrated how demand remains high for generative AI from Microsoft customers, and we continue to believe that Microsoft sits as a leader in this GenAI environment,” Gil Luria, an analyst with D.A. Davidson,

“Meta is indicating the results of further increased investment may be years away while Microsoft and Google are showing them right now.”

Additionally, the findings spurred a 3.4% increase in Amazon.com (AMZN.O), opening a new tab, which is scheduled to release its earnings on Tuesday. “The three hyperscalers (major cloud companies) we’ve heard from thus far all highlighted a similar message on AI capital expenditure – this is an arms race, the AI opportunity is enormous, and spending will continue to be aggressive/ahead of market expectations,” Michael Chiang, a Bernstein analyst, stated.

Alphabet’s capital expenditures jumped by 91% to $12 billion from a year ago, while Microsoft’s increased by $300 million from the previous quarter to $11.5 billion.

With Alphabet, at least 28 analysts increased their price targets; as a result, the median view increased from $156 at the previous close to $190. Analysts raised their price targets for Microsoft by at least 25, with a current median price objective of $475 for the shares.

Alphabet has a price-to-earnings ratio of 21.63, while Microsoft’s is 30.40 over the next twelve months.

According to certain analysts, the higher premium valuation was appropriate.

“Google Cloud made progress, but not as much as Azure. We (and the market) are waiting for Amazon Web Services to deliver results, but Azure’s enterprise emphasis and unique features played a role,” Bernstein analysts stated.