An agreement is signed by MTN Group Fintech and Mastercard to provide payment cards to MTN MoMo users.

An agreement is signed by MTN Group Fintech and Mastercard to provide payment cards to MTN MoMo users.

A deal has been reached between Mastercard and MTN Group Fintech to offer payment cards to all MTN MoMo users.

Specifics

Both businesses announced in a joint statement that every MoMo wallet will receive a physical and virtual Mastercard companion card, giving customers access to more than 100 million acceptance places worldwide.

The cards will be made available to all 60 million MoMo wallets with active monthly balances in the 13 countries (South Africa, Benin, Cameroon, Cote d’Ivoire, Eswatini, Ghana, Liberia, Nigeria, Republic of Congo, Republic of Guinea, Rwanda, Uganda, and Zambia) where mobile money services are offered.

Reaching Further

According to the companies, SME owners now have access to solutions that allow them to open an online store. These solutions include digital card acceptance, tap-on-phone capabilities, and QR enablement.

It will allow MoMo retailers to accept card payments in addition to enabling MoMo consumers to transact at standard payment terminals.

Additionally, the cooperation will increase the availability of mobile money remittance services in Africa for both domestic and international remittances.

What They’re Expressing

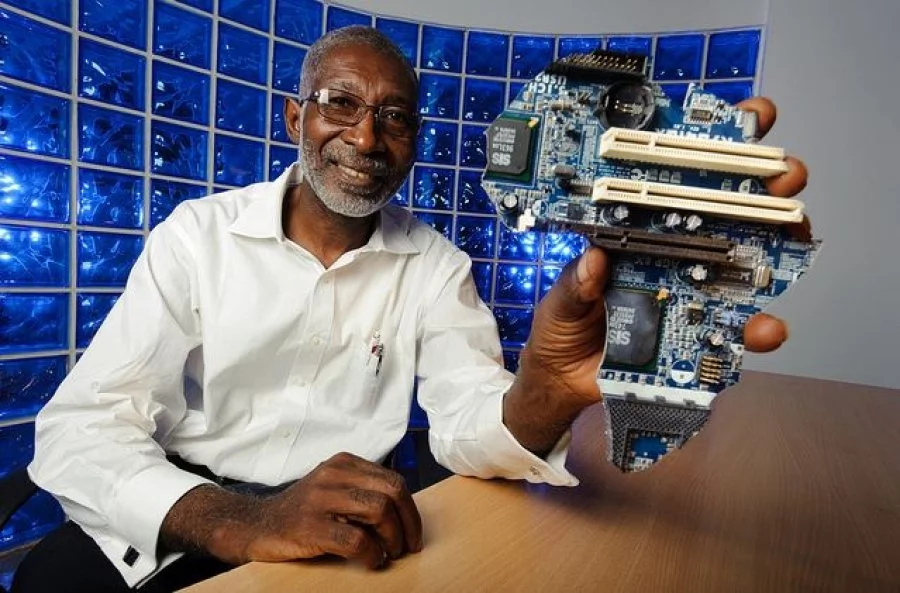

Amnah Ajmal, vice president of market development at Mastercard EMEA, expressed the company’s pride in the relationship that allows millions of Africans to engage in digital commerce.

“SMEs will benefit from the agreement by having access to low-cost payment solutions like Mastercard’s SME-in-a-Box, which enables small business owners to move their operations online and accept a variety of digital payments from their clients,” the statement reads.

The partnership will provide MoMo customers with best-in-class apps, enhanced user experiences, safe transactions, secure transfers, innovative use cases, and increased acceptability, according to CEO of MTN Group Fintech Serigne Dioum.

More than US$2 billion in transactions are performed every day for international remittance services, which is more than 40% of Sub-Saharan Africa’s GDP, according to Mastercard and MTN.

“With no signs of slowing down, international remittances via mobile money wallets grew by 65% year over year to around US$1 billion in 2020.”